Highlights

- Global demand for pilots remains strong: Boeing forecasts 649,000 new pilots needed by 2043 (source: Boeing Pilot and Technician Outlook 2024).

- European flight schools market pilot training as a “guaranteed pathway” to airlines, with programs costing €80,000–€150,000.

- Many schools advertise completion in 18 months and job placement promises — claims often far from reality.

- Graduates often face years without airline jobs, turning instead to flight instruction or leaving aviation entirely.

- Cadet programs (CAE, L3Harris, etc.) with airline partnerships create opportunities — but also risk sidelining pilots trained outside these pipelines.

- In the U.S., regional airlines and structured CFI pathways help low-hour pilots build experience — Europe lacks this bridge.

- The system risks alienating future aviators and wasting investment in training.

Overview

The aviation industry is caught in a paradox: airlines warn of looming pilot shortages, yet thousands of newly trained cadets remain grounded. The reason lies in a structural disconnect between flight training promises and airline hiring practices.

In Europe, flight schools advertise fast-track training programs with glossy brochures and claims of guaranteed jobs. Many cadets are told they will be airline-ready within 18 months. The reality is more complex: after investing upwards of €100,000, many pilots emerge with a licence but no immediate prospects, often forced into years of uncertainty.

This mismatch raises a burning question for the industry: if airlines truly need pilots, why aren’t they opening the door for newly qualified cadets?

Content

The flight school promise

Large European flight schools — including giants like CAE and L3Harris — offer integrated ATPL courses marketed as direct pathways to airlines. Ads often promise quick completion times (“18 months to the cockpit”) and job placement through cadet programs.

The reality is less linear. Training delays, medical hold-ups, exam bottlenecks and type rating availability often stretch programs well beyond two years. And even with a licence in hand, the “guaranteed job” frequently evaporates, leaving many cadets unemployed or underemployed.

The harsh reality

For those not absorbed by airline-linked cadet programs, options are limited:

- Flight instructors (CFIs) build hours but enter a career track different from airline flying, often out of necessity rather than passion.

- Type ratings purchased out-of-pocket can cost €30,000–€40,000, with no certainty of employment.

- Job hunts drag on for years, pushing some pilots to abandon aviation entirely despite having invested six-figure sums in training.

“I didn’t spend €120,000 to end up unemployed,” one former cadet told us. “I thought the shortage meant opportunities. Instead, I felt tricked.”

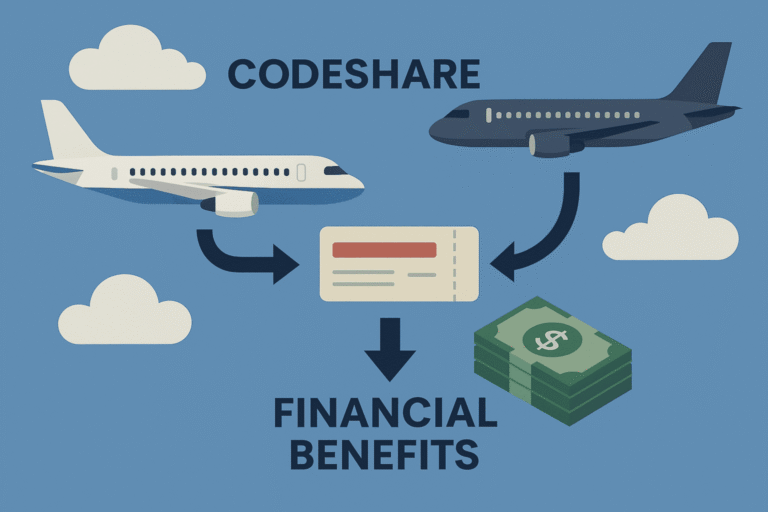

Cadet programs: solution or trap?

Cadet programs tied to airlines — such as CAE’s partnership schemes — are increasingly the only way into the cockpit. Airlines benefit: they get well-trained, standardized cadets. But for those who graduated before these schemes expanded, the effect is exclusionary.

If carriers only recruit through their preferred pipelines, what happens to equally qualified pilots who invested heavily in their licences but missed the timing? Are they left behind, despite the industry’s “desperate” need for pilots?

This raises a broader ethical question: are cadet programs solving the shortage, or deepening inequality among pilots?

The U.S. contrast

The United States offers a different model. Cadets leaving flight schools often become Certified Flight Instructors (CFIs), building hours while earning salaries. With 1,200–1,500 hours (depending on their training pathway), they are eligible for regional airline positions.

Regional airlines act as a structured “bridge” — a step missing in Europe. While not perfect, this system ensures cadets have tangible opportunities to grow from zero-hour pilots into airline-ready First Officers.

Analytical Insight

Europe’s current training-to-airline pipeline is unsustainable. On one side, airlines project shortages and struggle with retirements. On the other, thousands of cadets sit idle, burdened with debt and disillusionment.

The solution lies in creating structured, transparent pathways:

- airline-sponsored training with clear commitments,

- regional carriers or feeder programs designed for low-hour pilots,

- better regulation of training schools’ advertising to prevent misleading job promises.

Without such changes, aviation risks alienating the very generation of pilots it desperately needs. Investing in a licence should not feel like playing the lottery.

Conclusion

The pilot shortage is real, but so is the experience gap that keeps cadets grounded. Flight schools market dreams, cadet programs favor select intakes, and Europe offers no structured bridge for those in between. The result: wasted talent, wasted money, and mounting frustration.

For aviation to grow sustainably, airlines must stop being “picky” when they are hungry for pilots. Just as passengers expect safe, reliable flights, aspiring pilots deserve a transparent, achievable pathway from training to the cockpit. Until then, the industry’s shortage is less about numbers and more about broken systems.

Note: this article references Boeing Pilot and Technician Outlook 2024 as a data source. For deeper data on flight schools’ completion times and placement rates, Aviatica News will publish a follow-up article investigating “The 18-Month Promise: Myth vs. Reality of Flight Training Programs” — stay tuned.